I have been thinking of forming a good portfolio and a way to measure the success of my portfolio over time. The question was to arrive at a portfolio allocation scheme not exactly based on my guesswork but a slightly analytic scheme. My search for these brought me in touch with a demon and a paradox. Let us take these baby steps for starting to create a portfolio.

Shannon’s Demon: Making Money out of thin air.

Claude Shannon is very well known among electronics engineers for the ground-breaking work done by him in the area of Information Theory. But very few people know of his real expertise in stock market investing. The book “Fortune’s Formula”1 by William Poundstone captures his amazing work and his contributions to the field of investments. In the book, Shannon told an audience of a method to “Making Money from Air” especially if has completely random behavior and is volatile. This case study has been dubbed Shannon’s Demon.

Shannon’s Demon is a simple problem. Let us assume you have two assets A and B. Assume asset A works by flipping a coin. If “head” occurs, we get +100% or -50% in the case of “tails”. Asset B gives no return is cash independent of the toss outcome. Suppose Asset A has starting NAV of 1$. Suppose you had heads on the first toss, NAV would go to 1 *(1+100%) = 2.0. Subsequent “tails” would take your NAV to 2.0 *(1-50%) ~ 1.0. Note that just a 50% fall can negate a +100% move. We discussed here that what investors get is geometric mean and not arithmetic. So, while the arithmetic return is positive, the geometric return is zero. If you get an equal number of heads and tails (fair coin), Asset A should give you long-term returns same as Asset B that are no growth/returns.

But Shannon proposed an idea to make money grow despite the said conditions. He suggests that you invest 50% in each of the assets and after the very toss, “re-balance to 50%”. Let us take an example.

Initial NAV: 1 (50%A, 50%B = 0.5 each)

Toss 1(H): A = 0.5*(1+100%) = 1.0, B = 0.5. Total NAV = 1.50. Re-balance to 50% after round of winning/losing. This implies A = 0.75, B= 0.75

Toss2(T): A = 0.75*(1-50%) ~ 0.375, B = 0.75. Total NAV ~ 1.125.

This is greater than 1.0, our initial capital and that means a growth of 12.5 % after 2 turns.

So, we really did create money out of thin air in two-coin flips by the process of re-balancing compared to the original exercise. It must be intuitive that we will get an equal number of heads and tails eventually, and our long-term returns will be more for each pair of Heads and Tails suggesting growth in the portfolio. I created an example case in excel and I show below the same. Note that initial lower allocation to Asset A would make the strategy look bad but eventually, reality catches up and Asset A reaches its “destined” value whereas Shannon’s portfolio keeps chugging along. Notice also that the moves are less rugged indicating a possible “lower volatility.”

I would suggest readers even try it out at home and confirm that is indeed the case.

Eugene Fama and a bunch of folks propounded the EMH hypothesis which said that stocks’ daily movement is mostly a random walk, and most people cannot make money through the stocks as their prices reflect everything known to the world. But, as seen above, Shannon showed that even if markets are efficient, you can use the underlying volatility to make money through a process of diversification and rebalancing.

Parrondo’s Paradox2: In 1996, Juan Parrando proposed another surprising experiment (“Parrondo’s Paradox”) that showed another facet of investments and re-balancing. In this paradox, two “loser” assets provide higher returns by simply mixing and re-balancing them at every opportunity possible. An example is below3:

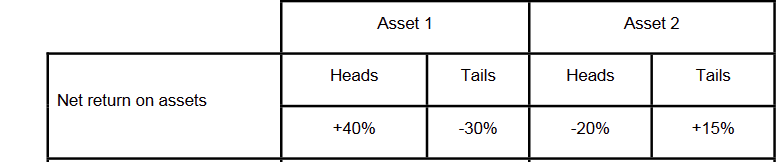

Let us take the case of a fair coin and look at the returns of Asset 1 (A1) and Asset 2 (A2) after one set of heads and tails.

Asset 1: Starting: 1.0 ==> Heads ==> 1 * (1+40%) = 1.4 ==> Tails ==>1.4*(1-30%) =0.98. This is a loss of 2% from a starting amount of 1.0

Asset 2: Starting: 1.0 ==>Heads ==> 1 * (1-20%) = 0.8 ==> Tails ==>0.8*(1+15%) =0.92. This is a loss of 8% from a starting amount of 1.0

Individually, both assets are horrible money losers along with high volatility in return streams. If you invest in them, you will eventually lose your entire capital.

Parrondo’s Paradox follows Shannon’s demon thought process and does a 50% allocation to each asset and rebalances after every iteration. Let us see what happens after 1 set of iterations of Heads and Tails.

Starting: 1.0, 50% A1, 50% A2 ==> A1 = 0.5, A2 = 0.5

Heads ==> A1 = 0.5 *(1+40%) = 0.7, A2 = 0.5*(1-20%) = 0.4. Total NAV = 1.1. Rebalance back to 50-50 means A1 = 0.55 and A2 = 0.55

Tails ==> 0.55 * (1-30%) = 0.385, A2 = 0.55 * (1+15%) = 0.6325. Total NAV = 1.0175. This is a 1.75% increase in NAV from starting point. This observation of taking two losing assets and a process of rebalancing providing higher returns had stumped people. It has been a “paradox” since his discovery. I provide an example in excel to show the same.

If we look at the assets carefully, we may realize that it may not be paradoxical after all. On a head, A1 provides positive returns whereas A2 provides negative returns. On the other hand, A2 provides positive returns on Tails but A1 provides negative returns. This insight gives way to a “hedging” strategy. The key is to rebalance as well. If you do not rebalance, assuming a 50% allocation to each asset, you will still lose money.

Other thoughts

I hope the above tells you that there is more to investments than selecting the right stocks or mutual funds. Also, do not have fixed opinions on any asset class or individual assets. Being open to the possibility to make money through a combination process is more helpful. I keep hearing opinions that gold is a useless asset or real estate makes no money or for that matter, stocks are all about gambling, and off late opinions on cryptos are developing on either side. I would urge readers to accept all forms of investments, understand their underlying risks/benefits, and look at portfolios holistically. Do not summarily reject any asset/asset class. This ability to be open to possibilities can help us, individual investors, to look for growth in wealth.

Summary

Shannon proved that assets with high volatility, by a process of rebalancing, provide for better outcomes to portfolios. Assets with differences in behavior provide for a strategy to grow wealth. Through these perceived paradoxes, we start our journey of portfolio creation.

Fortune’s Formula by William Poundstone

An earlier version had the name wrong as Parrando. It is corrected to Parrondo.

From “The Joy of Volatility” by M.A.H Dempster and others. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=983112

Have you been able to simulate this for the Indian stock market? For example, Portfolio 1 (Nifty 50, Next 50, Midcap 150, Smallcap 250, Gold) vs Portfolio 2 (Nifty 100, Midcap 150, Smallcap 250, Gold) vs Nifty 500.

Also, would you know of any site that is India version of Portfolio Visualizer (https://www.portfoliovisualizer.com/backtest-portfolio) ?

Consider liquidity. There is always someone on the other side of the trade. You profit, often at their expense.